Table of Content

Ask if your plan permits “in service distributions”. If it does, then you can a minimal of do a partial rollover/transfer. Anyone can roll over a 401 to an IRA or to a new employer's 401 plan when leaving a job. Depending in your plan's insurance policies, you may have the ability to make the rollover when you're nonetheless with the company. Unlike a post-job rollover, your plan would not have to permit in-service rollovers, but many companies do.

Reading financial headlines is a crucial part of my job as CEO of U.S. Not only do I want to remain as informed as possible, but every once in a while, I come across one thing actually fascinating that I’m then in a place to pass alongside to the remainder of the... As I write this, millions of Americans are heading out to the polls to vote within the 2022 midterm elections. As I continue to observe headlines relating to the possible financial impact of this year’s election, I get excited about the future—specifically, the lengthy run I want...

Ideas On “can I Rollover My 401k While Nonetheless Employed?”

Financial advisors love this to use this to their benefit. I am 34 yo and want to withdraw the money I placed in a 403 with my current company. I actually have no reason for doing so besides to withdraw the money “I invested” over the past five years to move nearer to turning into debt free . There are a number of bigger corporations that offer “in service withdrawals” and the flexibility to do so relies on the 401k plan paperwork which you'll be able to get hold of from the Third Party Administrator .

They state there place is per “statute”, but can not produce such statute. I am working for an employer who has frozen their contributions to their worker 401K. We ought to change the regulation then to let individuals decide what to do with their own cash. Sure, cost the suitable penalty, but as adults, we must be allowed to make our own choices even if the “experts” don’t agree! Last time I checked I thought we were in a free nation, even if that results in a mistake. How patronizing and arrogant these 401k admins are to assume they know better than we do as to what we do with our personal money.

Ira Deduction Limits 2023

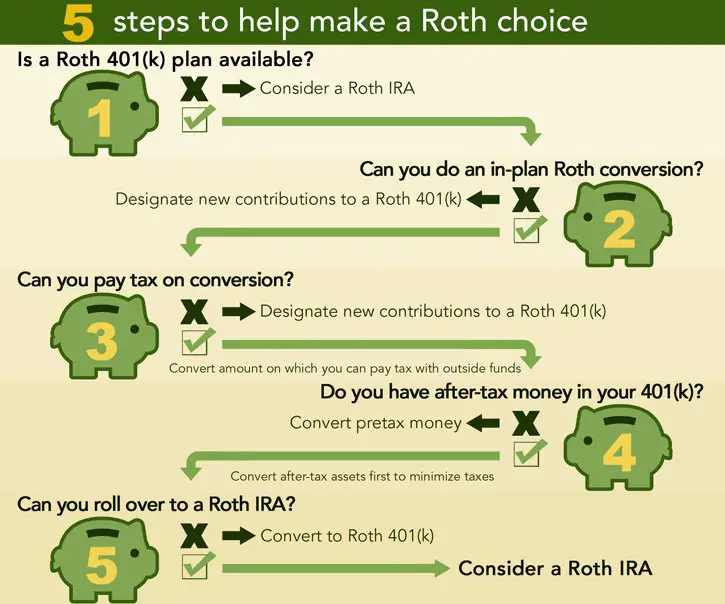

But in today's more transient office, people typically change jobs. If taxpayers didn't have the choice of rolling over their 401 funds from a former job to a brand new job, the 401 program will not be as helpful as it has turn out to be. But as a end result of 401 funds are "transportable," this means they will transfer from plan to plan. If your previous employer disburses your 401 funds to you, you may have 60 days to rollover these funds into an eligible retirement account. Take too lengthy, and you'll be subject to early withdrawal penalty taxes. If you roll a standard 401 over to a Roth individual retirement account , you'll owe revenue taxes on the money that yr, however you'll owe no taxes on withdrawals after you retire.

If it's a Roth rollover, you will pay tax on the transfer, however your withdrawals down the street will be tax-free. You can withdraw the money and make the transfer yourself, but if you do not full it within 60 days, you may face hefty tax penalties. Not all employers enable in-service rollovers, however many do. According to the Profit Sharing/401 Council of America , up to 77% of 401 plans embody a provision for in-service 401 rollovers. Typically, employees transfer cash out of a 401 and into other retirement accounts after quitting a job, dropping a job, or retiring. Diversification.Investment options in your 401 may be limited and are chosen by the plan sponsor.Rolling your funds over into an IRAcan usually broaden your alternative of investments.

Reap The Advantages Of An In-service 401k Rollover For The Advantages Of An Ira Whereas Nonetheless Preserving Your Job

I rolled in over into an IRA (under my control, a lot happier and doing so much better!). I am at present a pension administrator and process many distributions which are rollovers. In order for any distribution to be “rolled over” it must meet the criteria as given within the article listed above. Each week, Zack's e-newsletter will handle topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more.

Most individuals solely think about rolling over their 401 financial savings into an IRA once they change jobs. For many individuals, that is a perfect time to shift funds as a outcome of they will consolidate a quantity of retirement accounts from previous employers in one place and benefit from extra funding choices. Though there might be causes not to do so as properly. If you are considering withdrawing from your 401 while nonetheless employed, you will want to analysis your present plan and the options available. Check with your employer that non-hardship, in-service withdrawals from your plan are allowed, and communicate to a fee-only monetary advisor to ensure it falls consistent with your larger money technique.

What Is A Thrift Savings Plan Account Rollover?

In fact, there might be truly an choice called the in-service 401K rollover that may allow you to maintain working for your employer while benefiting from the flexibility and management of an IRA. Or it'd provide you with entry to a half of your retirement belongings so that you just can manage them as desired. Question–I am age seventy five and nonetheless working with an organization 401K and plan to work for one more 12 months.

IRAs for example usually have fewer legal protections than 401s, and you can't borrow from your IRA like you'll be able to from a 401. An in-service withdrawal or rollover can also interrupt your 401 contributions out of your pay check. Some suppliers could not allow you to make tax-deferred deposits into your 401 for a set period following an in-service rollover.

What Are The Principles For Rolling Over A 401k?

That’s why it’s necessary to assume about all lending options earlier than borrowing from a 401. 3) On your subsequent tax return, claim the combination of the 401K withdrawal and subsequent deposit to IRA under 60 days as a non taxable distribution, and get the withheld tax a refund. 2) In less than 60 days, deposit what is left after taxes into an IRA, along with your individual cash to make up the taxes they withheld.

Be certain to rollover the money to an IRA if you don’t need it. By doing a 401k in-service withdrawal you might be taxed. I took a call from a consumer lately whose employer was on the brink of change 401k suppliers once more and was frustrated with the new funding choices. Is optional, and some firms don’t provide it of their 401s. So, earlier than making use of, the worker should verify with the HR department to see if it’s an choice to pursue. However, they’ll lose some of their financial savings on tax retributions and decrease their general pension fund.

Be aware although, that withdrawing the cash to pay debt and rolling it over into an IRA are two very different events. Being in a position to rollover the employer contributions was a fantastic opportunity for him diversify his porfolio, get back to a greater asset allocation, and contribute to more price effective funds. The penalty (defined specifically by his company’s plan) was that he could not contribute to his plan for 12 months beginning from the day the withdrawal occurred. The 401 to IRA rollover occurs when staff swap between retirement packages. It often occurs after leaving an employer, but employees can roll over their money while nonetheless employed if the corporate 401 permits it. About time worth of cash, you financial majors understand this!

Past efficiency of the coin or the market can not predict future efficiency. You will still get any employer matching that may be offered by your office. Receive full entry to our market insights, commentary, newsletters, breaking news alerts, and more. The 401 money will get a considerable deduction, making long-term income rather more troublesome.

And, as a lot as there are benefits to them, savers ought to be cautious with these disbursements. They mustn’t withdraw money unless necessary and ought to be cautious to keep away from ruining any prospects for future retirement. I totally forgot in regards to the exception in SOME firm plans for an “in-service4” rollover. I still don't have any answer if my employer stops contributing to my 401K…….4 years with no contributions, is that this a qualifying event that may permit me to rollover my 401K to a tax defered IRA. All the money that Financial company and employer got is from worker. So you need rollover it as soon as you left the company.

No comments:

Post a Comment